Ssi Maximum 2025

Ssi Maximum 2025. For earnings in 2024, this base is $168,600. Tscl updated its 2025 cola prediction based on may's.

The supplemental security income program also receives an increase when retirees and disability. The senior citizens league updated its expectations for the 2025 cola after may’s inflation reading came in better than expected.

For The Roughly 94% Of.

The maximum federal ssi payment in 2024 is $943 a month for an individual and $1,415 for a married couple who both qualify.

Here's The Maximum Possible Social Security Benefit At Ages 62, 66, 67, And 70.

This final rule announces one of several updates to supplemental security income (ssi) regulations that will help people receiving and applying for ssi.

Ssi Maximum 2025 Images References :

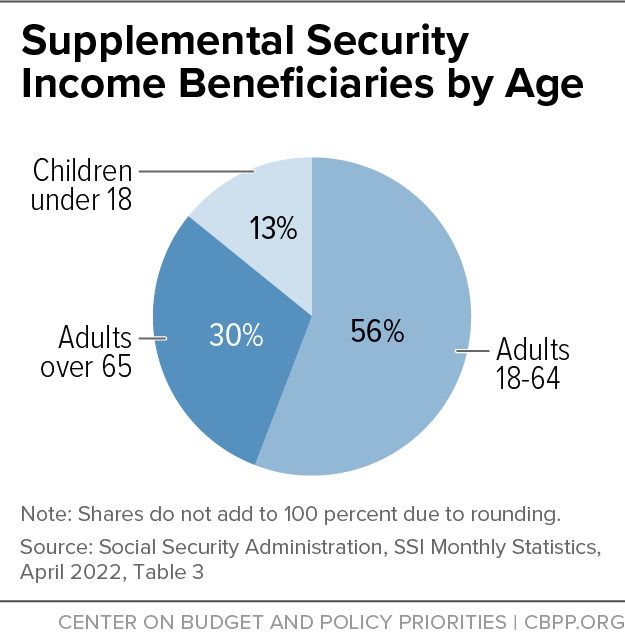

Source: www.cbpp.org

Source: www.cbpp.org

Policy Basics Supplemental Security Center on Budget and, *all presumed values are rebuttable. Benefits can be reduced based on income from other sources such as.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, The taxable wage base estimate has been released, providing you with key. Age 65 to 67 (your full retirement benefits age):

Source: onidaqhonoria.pages.dev

Source: onidaqhonoria.pages.dev

How Much Will Social Security Increase For 2024 Remy Valida, Istse olympiad scholarship 2024 registration,. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

Source: www.bankers-anonymous.com

Source: www.bankers-anonymous.com

Social Security Spreadsheet Fun Bankers Anonymous, The current social security cola projection for 2025 is 2.57%, according to the senior citizens league. The maximum federal ssi payment in 2024 is $943 a month for an individual and $1,415 for a married couple who both qualify.

Source: www.youtube.com

Source: www.youtube.com

324 RAISE! BIG CHANGES 2025! SSI SSDI VA Payments Social Security, Here's the maximum possible social security benefit at ages 62, 66, 67, and 70. What's the maximum you'll pay per employee in social security tax next year?

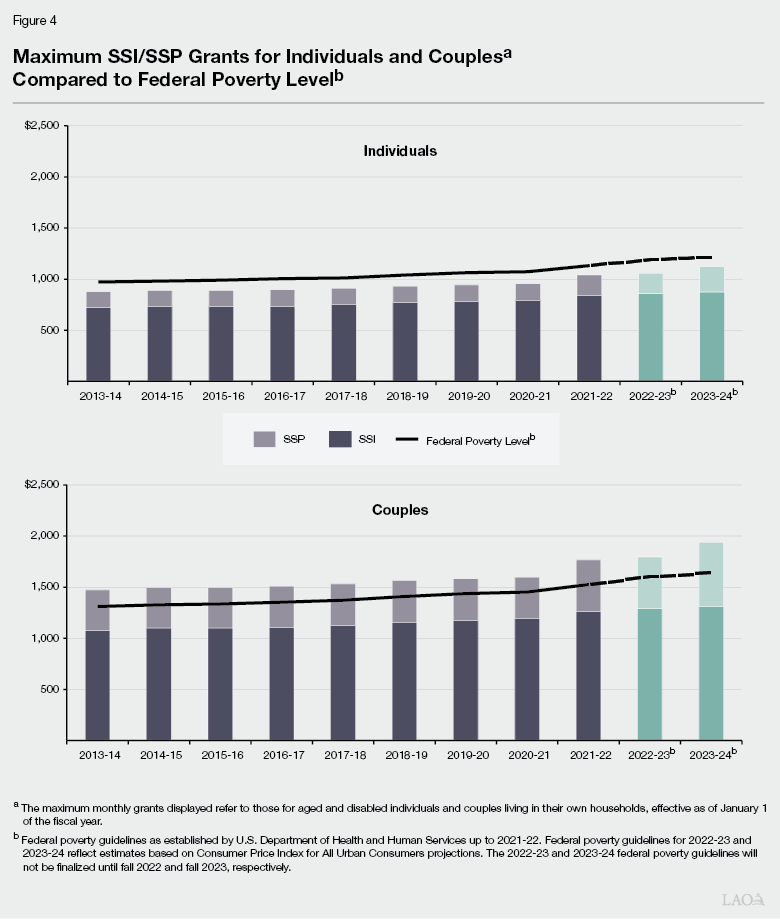

Source: lao.ca.gov

Source: lao.ca.gov

The 202223 Budget Supplemental Security Supplementary, What's the maximum you'll pay per employee in social security tax next year? *all presumed values are rebuttable.

Source: lowerylegal.com

Source: lowerylegal.com

Social Security Supplemental SSI Attorney in Charleston SC, As the rate of inflation moderates, the social security cola for 2025 might be 3%, according to the latest estimate from mary johnson, an independent social security and. For earnings in 2024, this base is $168,600.

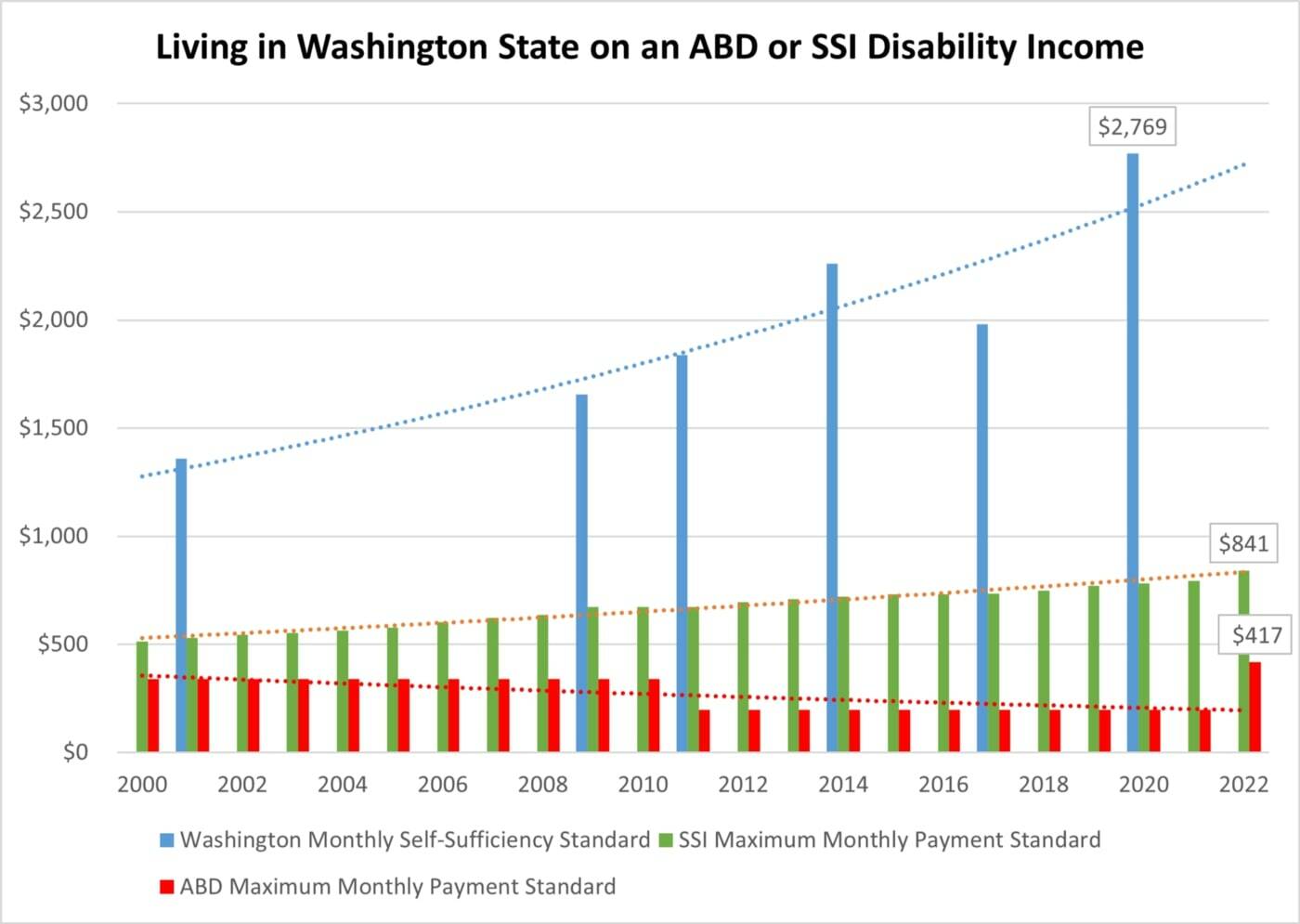

Source: www.bothell-reporter.com

Source: www.bothell-reporter.com

First time in history DSHS increases cash assistance grants for Aged, Here's the maximum possible social security benefit at ages 62, 66, 67, and 70. With the prices for goods and services rising, nawi should climb in 2025 and lift the maximum taxable earnings cap above $168,600.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Maximum Social Security Benefit 2022 Calculation & How to Get It, This amount is expected to increase in 2025. If you earn enough to qualify for the maximum possible social security benefit, it still.

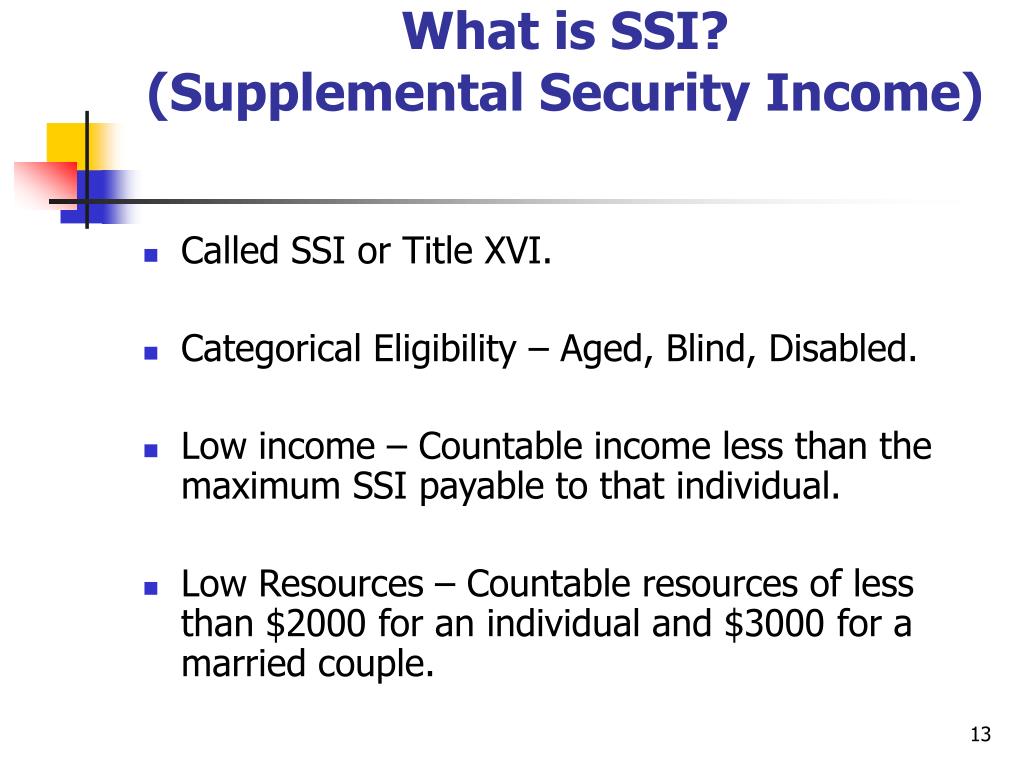

Source: www.slideserve.com

Source: www.slideserve.com

PPT SSI and SSDI Basics PowerPoint Presentation, free download ID, This amount is also commonly referred to as the taxable maximum. With the prices for goods and services rising, nawi should climb in 2025 and lift the maximum taxable earnings cap above $168,600.

For Example, If You Retire At Full Retirement Age In 2024, Your Maximum Benefit Would Be $3,822.

We refer to this reduction as the windfall.

*All Presumed Values Are Rebuttable.

This amount is expected to increase in 2025.

Category: 2025